How to Survive A Hard Liability Market

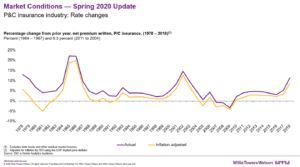

The liability marketplace has been soft for a record number of years. For nearly a decade, clients have gone through liability renewals with little to no increase in rates, almost regardless of claim activity.

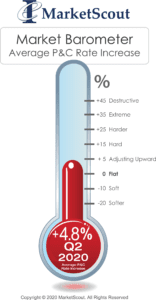

Since the beginning of 2019, we have experienced a rapidly hardening insurance market.

What Contributes to a Hard Market:

- Adverse loss trends/catastrophic losses – both the frequency and severity of claims is on the rise. Auto Liability and Employment Practices Liability have been loss leaders and carriers are not collecting enough premium to cover the cost of claims. Litigation trends and increased medical costs have also led to higher payouts.

- Decreased carrier capacity – as carriers take on poor loss experience, they respond by restricting the classes of business and lines of coverage they want to insure.

- Decrease in carrier investment returns – typically the bulk of carriers’ profits are from investment returns even if they have an unprofitable underwriting year. Reduced returns are causing carriers to restrict their underwriting appetite.

- Lack of Reinsurance – as reinsurance becomes more costly or difficult to obtain, underlying carriers will increase rates as they are forced to take on more of the primary exposure or they will exit classes of business entirely.

What to Expect in a Hard Market:

- Premium increases/lack of affordable coverage

- Increased scrutiny on submissions – requests for additional applications, historical data, detail on losses, controls and exposures

- Restrictions in coverage – in either policy form or requirements for increased retentions

- Unavailability of higher limits or coverage enhancements

- Conditional or non-renewal notices

- The need to change carriers, work with a greater number of carriers or obtain coverage through the excess/surplus lines marketplace

How to Survive a Hard Market:

- Stay ahead of the renewal process and communicate early with your advisor to identify how you will be impacted. A good Risk management program happens 365 days/year not just 90 days prior to your renewal. A good Risk Management Audit process is continuous and evolves as your business risk changes.

- Be prepared to provide much more detail at the time of renewal. An Agent that knows you and your business well will be able to recap your risk profile in an Executive Summary format for the markets. This will aid in their evaluation of your risk compared to others in the same class/industry. It is most helpful in maintaining good carrier confidence in your business.

- With shrinking capacity, carriers will be decreasing the number of brokers and wholesalers they work with. Be sure to partner with an agent with strong carrier relationships and knowledge of your industry.

- Work with your agent advisor to review your policies and procedures to understand where improvements can be made to secure more favorable quotes or reduce your liability to uninsured losses where coverage restrictions are imposed.

- IQRM Assessments help us identify key areas of concern. Once completed, we can focus on the top 3 best practices to improve your risk profile prior to your account being submitted for underwriting scrutiny.

- Get involved in the underwriting process. Talk to the underwriters directly, meet them and develop a relationship with them. This is a 3-prong relationship; you, your agent advisor and the insurance carrier. All three play a key role in managing your risk.